Crew welfare matters: Prioritising prompt and reliable payments for happy and productive seafarers

Over the past decade, the drive towards improving crew welfare and satisfaction has increased exponentially.

Accelerated by the pandemic and shifting political and geographic tensions, ship owners realise that they need to go the extra (nautical) mile to ensure the welfare of their crews.

But what springs to mind when you think about crew welfare?

The current conversation may look at areas such as nutrition, physical and mental health support, the availability of communications and connectivity while at sea and a few other areas. As well as those topics, improving access to funds and the reliability of payments to crew is one area where shipping firms can see outsize returns.

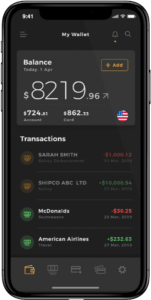

According to a study by PYMNTS, employees who received wages through an E-Wallet have a 16% higher satisfaction rate than those paid through direct deposits, so paying employees via E-Wallet can improve happiness by providing crew with more tangible control over their finances, higher security, and an improved sense that they are valued by their employer.

But perhaps we’re getting ahead of ourselves. After all, existing payment methods have worked well for dozens (even hundreds!) of years in some cases. Why the need for change, and why now?

The short answer is that we now live in a digital world. On dry land, we have become used to fast, secure transactions backed up by intuitive user experiences.

E-Wallet use has grown exponentially over the past decade, with more than 5bn expected to be in use by 2026. The simple fact is that E-Wallets are now commonplace. They are convenient and secure, and seafarers are no longer satisfied with the clunky, outdated options they are often faced with.

Aside from a feeling of greater connection and control over their funds, E-Wallets offer many additional, more practical, benefits to seafarers, including:

- A vast reduction in paper-based processes, improving their ability to budget efficiently

- A streamlined payment process which reduces the risk of delayed or lost payments

- Improved compliance checks and increased personal protection against the shifting sanctions landscape

- Instant access which can help improve their individual financial security and drive greater wellbeing

- Less reliance on cash or need to carry large sums, increasing security

- Reduced costs to send or convert currencies

How can you benefit?

For shipping companies, there is also a risk associated with not offering digital payments. Beyond improving levels of career satisfaction and retaining employees, it is also a crucial element when it comes to attracting new talent. In a 2022 study by Thetius, more than one in three seafarers chose personal access to digital technology as the key factor when choosing a new employer.

With so much to gain, there has never been a better time to consider introducing E-Wallets for your crew. As with any new technology however, there are some precautions you should always take to ensure a smooth transition and maximum return on your investment.

By partnering with an established E-Wallet provider like MarTrust, you can ensure that payment processes are streamlined securely.

“Working with MarTrust has assisted our daily payment business significantly. Once the system was implemented, the number of payment queries decreased noticeably, the transfer costs more than halved, and a much wider spectrum of currencies is available, allowing for savings on foreign exchanges. The support is professional and swift with a dynamic team who know the maritime industry and its requirements” – Martracon Deutschland

Make sure you understand how you want to roll out the solution to your crew in advance. In some cases, businesses may mandate the use of a new technology, but for greater uptake and engagement, you might also consider choosing a test pool to trial the solution.

In many cases, choosing a few ‘champions’ to test out the technology can create a much greater appetite from the rest of the crew, and ultimately shorten your adoption process.

An experienced partner like MarTrust will be able to help you identify the method that will work best for your business, and guide you through the process, providing resources and training for crew, while also working with the wider business to ensure secure, timely setup and rollout.

Key takeaways:

Adoption of E-Wallet technology for crew payments is a prevailing trend, with many large ports now looking at ways to digitise payments and reduce paperwork, this is the ideal time to switch to an E-Wallet solution.

E-Wallets and digital payment options will also help future-proof your business, encouraging staff retention and helping you attract new talent.

Beyond the benefits to your business, E-Wallets have a measurable impact on the overall happiness and satisfaction of seafarers. By prioritising digital payments, you will be increasing the productivity (and profitability) of crew.

—

For more information, contact us today by clicking the REQUEST DEMO button at the top of the page at Maritime payroll and business payments | MarTrust